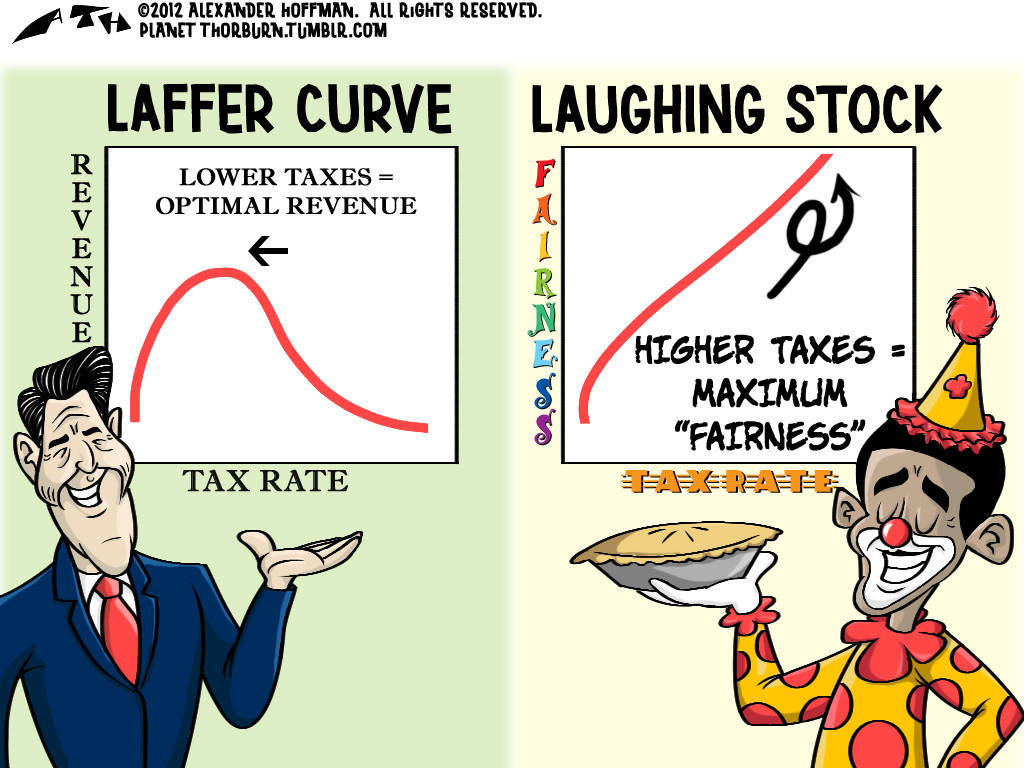

Clown economics

Posted on March 9th, 2012 by Alexander Thorburn Hoffman

Alex Hoffman is an award winning political cartoonist. His cartoons have been published by The Daily Bruin, The Commentator, Cartoon Movement, American Thinker and The Libertas Institute. He's currently the graphic artist behind Townhall's political ecard site, Freedom Cards.

Latest posts by Alexander Thorburn Hoffman (Posts)

- Pesky flies - January 25, 2013

- A disturbance in the force - November 2, 2012

- Trick or cheat! - October 27, 2012

- He’s just too similar to Bush - October 19, 2012

- Voters should have a choice of more than two flavors - October 5, 2012

Print This Post

Print This Post

The funny thing is, according to a real Laffer cruve, the optimum taxation rate would be between 50 and 70%, which has not been hit yet with regard to the income group Obama wishes to raise taxes on.

1) That can’t be true, because Reagan reduced the top tax bracket from 70% to 28% (which under your theory would be further away from maximum revenue), yet received 5 times as much tax revenue from those in that bracket.

http://www.cato.org/publications/commentary/lesson-laffer-curve-barack-obama

2) The purpose of the Laffer Curve is to show that tax policy affects individual behavior, with higher taxes being a disincentive to making money. People either forgo money making opportunities knowing the government will get a sizable cut of their efforts or they attempt to avoid paying taxes they deem are too high (off shore profits, moving companies overseas etc). The Laffer Curve merely shows optimal revenue, but optimal revenue doesn’t mean maximizing economic growth in the country. Higher taxes hurt economic growth period, even if they fall on the left slope of the Laffer Curve. However, if you are going to make the argument we need tax increases or “revenue increases” as the left calls it in order to pay for deficit spending, the Laffer Curve serves as a logical argument against it, because thar ain’t no gold in them thar hills.